All Categories

Featured

Table of Contents

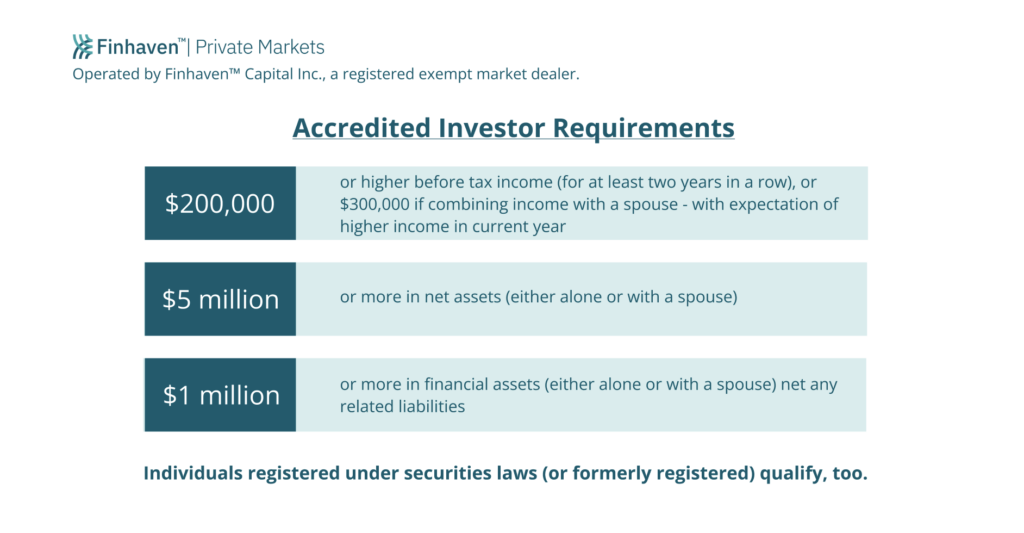

A recognized financier is an individual or entity that has a specific degree of economic class. The idea is that if investment possibilities restrict engagement to financiers that can pay for to take even more danger and have the ability to perform due diligence on investment chances, there is less of a need to sign up with companies designed to safeguard individual capitalists, especially the SEC.For individuals, there are 3 main ways to qualify as an approved financier: By income: A specific investor can be thought about a recognized capitalist if they have annual revenue of a minimum of $200,000 for the previous 2 consecutive years and a reasonable expectation of reaching this income level in the existing year.

By possessions: People can be taken into consideration accredited investors if they have a web worth (possessions minus financial obligations) of at the very least $1 million, not including their key residence. The $1 million threshold puts on both individuals and wedded pairs. test to become an accredited investor. By credential: Individuals that hold a Series 7, Series 65, or Series 82 license are accredited financiers

A retired individual with $2 million in possessions and extremely little income would certainly certify. If an individual had yearly revenue of $220,000 in 2021, $250,000 in 2022, and is on track to make $275,000 in 2023, however only had a net worth of $200,000, they would certify as an accredited investor simply by income.

Directors, exec police officers, or general partners of the firm marketing the securities are likewise thought about certified investors, despite their income or properties. And there are several ways that companies or various other entities can certify as certified investors. Corporations with more than $5 million in assets will certainly certify.

The typical theme is that these types of financial investments have incredible reward capacity. Picture if you had taken part in a very early investment round for (0.9%) or (3.69%).

Sec Accreditation

The concept is that the SEC intends to secure investors that can not manage to tackle dangers and soak up losses, or that do not have the financial class to totally comprehend the dangers involved with financial investment chances. This is why investments that anyone can place their money in (such as publicly traded stocks) are very closely watched by the SEC.

This procedure depends on the issuer of the safeties or financial investment possibilities. Some might verify your certification standing themselves, such as by requesting for income tax return or possession statements. Some might simply ask you to self-certify, while others could utilize a third-party verification service, such as the specific process, the majority of companies that use unregistered investment opportunities take considerable steps to make sure that just accredited investors participate.

The biggest instance of possibilities offered to accredited financiers is exclusive equity investments, such as venture resources bargains or direct investments in early-stage business. Well, accredited financiers might be able to take part in endeavor financing rounds led by VC firms.

The has settings in and recommends Meta Platforms and Tesla. The Motley Fool has a disclosure plan.

Is it your very first time looking for info on just how to become an accredited investor in the U.S., however not sure where to start? The efficient day of the brand-new guidelines was December 8, 2020.

Regulatory authorities have rigorous guidelines on that can be considered an approved investor. Under new regulation, people can currently qualify as an accredited financier "based on actions of specialist understanding, experience or accreditations along with the existing examinations for earnings or total assets." To be thought about a recognized capitalist, individuals will certainly require to supply substantial evidence that individual internet well worth exceeds the $1 million threshold.

Certification Of Accredited Investor

Total web well worth needs to include all existing assets that exceed the greater of $1 million. And these possessions leave out the main house and the worth thereof. The purpose of governmental bodies like the SEC's regulations for investor certification is to give protection to capitalists. The certification need seeks to ensure that capitalists have adequate knowledge to understand the threats of the prospective financial investment or the funds to shield against the risk of financial loss.

There must additionally be a practical expectation that they will gain the exact same or more in the present schedule year and the coming year. The 2nd way an individual can end up being a recognized capitalist is to have a web well worth surpassing $1M. This omits the value of their key house.

Once more, this is done either using income or using net worth financial declarations. An individual along with their partner or spousal matching will be considered certified investors if they have a pre-tax joint income of at the very least $300,000 for the 2 previous years. accredited investor look through. They must also get on track to make the exact same quantity (or even more) in the future year

Furthermore, the SEC has actually offered itself the versatility to reassess or include accreditations, designations, or qualifications in the future. The last of the main manner ins which an individual can be regarded a recognized financier is to be an educated worker of an exclusive fund. Knowledgeable staff members are specified as: An executive policeman, supervisor, trustee, general partner, consultatory board participant, or person offering in a comparable capability, of the exclusive fund or an associated administration person.

The following can also certify as certified investors: Economic organizations. Educated workers of private funds.

In the 1930s, federal lawmakers were looking for a way to shield financiers while also spurring brand-new service development. The Securities Act of 1933 was established to control offers and sales of securities in the USA - accredited investor check. The concept was to do so by calling for firms to register a declaration with a selection of info

How To Become A Private Investor

The enrollment required to be deemed effective before it could be supplied to capitalists. Regulators required to guarantee that only skilled investors with enough sources were taking part for safeties that were not registered. These opportunities do not drop under federal or state protections laws. As an outcome, Regulation D of the Stocks Act of 1933 was established and the term approved financier was birthed.

Only investors that certified because of this would have the ability to take part in personal protections and personal investment offerings. By doing so, they desired to strike an equilibrium that would certainly promote company development and also shield less experienced competent investors from riskier financial investments. seedinvest accredited investor. As these regulations remain to progress, the knowledge and certifications needs end up being more and much more vital

Latest Posts

Tax Lien Homes Near Me

How To Get Tax Lien Properties

Investing In Tax Lien Certificate